What We Offer

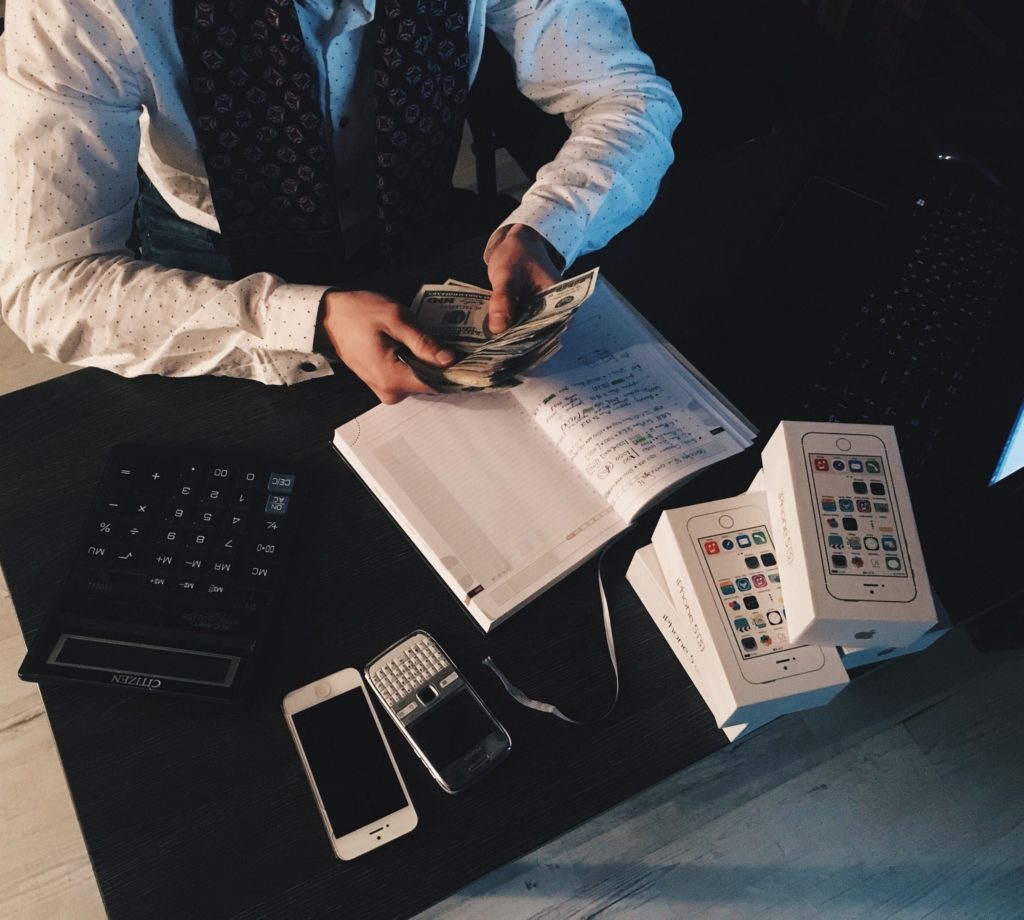

ACCOUNTING

Our expertise in communicating financial information to you, will give the decision makers of your business the confidence to make well informed sound business decisions. The accounting services we provide can assist your organisation with periodic, monthly or annual accounting work on a computerised system. Whether it is monthly bookkeeping; the management accounts; annual financial statements or compiling budgets, we provide professional efficient services to cater for all business requirements.

We offer the following services related to accounting:

- Preparation of books of accounts

- Payrolls

- Monthly management reports

- Annual financial statements

ACCOUNTING SOFTWARE

We are resellers of QuickBooks and Pastel accounting software solutions

We offer the following services related to accounting software

- Providing independent advice of the software best suited for your business

- Purchasing the appropriate software at a competitive price

- Installing and customisation of the software at your business premises

- Training current and new staff to utilise the software

- Advice on cloud based accounting solutions

BUSINESS ADVISORY

Our aim is that our clients see us as trusted business advisors.

Whilst ensuring prompt and efficient compliance with your accounting, tax and statutory obligations is often a significant part of our role, we aim to provide you with tailored advice for your unique circumstances.

We provide close support, combining knowledge of accounting, tax and business issues which has proved invaluable to clients involved in transactions, business planning and contentious litigation situations.

Transaction support

As a multi-disciplinary firm we can advise in an integrated fashion on a wide range of issues including valuations, negotiation, due diligence and the all-important tax structuring, both personal and corporate. We often work closely with our clients’ other advisors, becoming part of an integrated transaction team.

We frequently act in an active advisory role in purchase/sale transactions, acting as either leaders or part of the negotiating team. Our transaction support services range from valuations, to in depth corporate investigations and due diligence for the investors or lenders. As a multi-disciplinary firm we ensure that the important issues of tax structures, both personal and corporate, are closely integrated with our other advice, and supplied under one roof.

Financial and tax due diligence

A full due diligence exercise should enable you to learn the truth about a business, before you buy it, and is often an absolute necessity.

The advantage of commissioning investigative reports from us is the close involvement of our partners, and the depth of experience which is at your disposal.

Business planning and advice

Our partners have wide experience gained both from advising clients and from roles as financial managers and chief financial officers.

We therefore bring practical commercial, accounting and tax expertise to your situation. Additionally, we have a wide range of tools at our disposal, including business planning and budgeting models.

Our aim is to help you in your strategic and tactical planning and to give you an objective, informed view, which can often be the crucial missing ingredient or the catalyst to evolve and develop the strategy.

IT DEVELOPMENT

We have teamed up with an IT development team that enable us to develop bespoke software solutions required by your business. Whether you require business process driven software or software that enable higher efficiencies, we are able to design the user requirements with you and design the most economical solution for you.

Our goal is to deliver services and solutions to reduce the Total Cost of Ownership (TCO) and increase Return on Investment (ROI). We are able to deliver industry leading services and solutions that are qualitative and cost effective.

PUBLIC SECTOR CONSULTING

In today’s world of extreme austerity, public sector organisations are increasingly demanding practical consultancy support that results in higher levels of service and delivery, including value for money.

The ever increasing pressure on the provision of public services, with the focus on service delivery and the need for financial discipline, makes the use of expert advisers increasingly valuable. New policies and initiatives are continually being introduced placing a premium on the ability to respond innovatively and quickly in order to deliver value-for money services. Our experience of working across a wide range of public sector organisations enables us to offer you the support necessary to achieve your objectives.

We have been delivering support and advice to the public sector for a number of years and have a dedicated and experienced team of full-time consultants. We have a specialist public sector consulting group with a team of consultants, expert in assignments within National, Provincial and Local spheres of Government.

Within the public sector consulting group, many of the team have both commercial and public sector management backgrounds as well as a wealth of experience in specialised public sector issues

We offer the following broad services

- Annual financial statement preparation

- Development of unit standards aligned training material

- Facilitation of training courses

- Design and facilitation of customised training

- Financial management consulting

- Budgeting and strategic planning

- Fixed Asset Management

- Supply Change Management

TAXATION

Personal tax

We advise individuals on personal tax planning with the aim of mitigating income tax, capital gains tax and estate duty liabilities. We continue to devote significant resources, both human and technical, to maintaining and enhancing our personal tax services to private clients. Legislation surrounding issues relating to private individuals, such as tax self-assessment, capital gains tax and estate duty is constantly changing and becoming more complex.

Our expertise within this area allows us to offer advice on the most recent developments whilst tailoring this to each client’s needs. Our services include tax planning, estate planning, tax compliance and remuneration planning

Corporate tax

Businesses face the increasing pressure of ever more rules and regulations, with business tax complexities often consuming a large amount of management time and effort. We will help you incorporate tax efficiency into your business planning and decision-making to put you in control of tax costs and generate long term savings.

We realise that managing your tax compliance burden efficiently can have a significant impact on your business. Whether you outsource your business tax processes to us completely or simply need advice to help you streamline the paperwork and deal with specific issues, we can deliver the quick, efficient service you need. When the tax issues seem complex you will find our business tax advice and solutions relevant, practical and cost-efficient.

Our services include :

- Registration for Income tax, VAT, UIF, PAYE, SDL and Turnover tax

- Compilation and submission of Income Tax returns

- Compilation and submission of Provisional Tax returns

- Compilation and submission of VAT returns

- Compilation and submission of PAYE/UIF/SDL returns

- Compilation and submission of EMP 501 returns

- Tax planning

- Tax advice

- SARS audit

TRAINING

We provide training programmes to both the public and private sector organisations across South Africa. Our core training is focused on financial management. Our sister organisation Invictus Consulting CC is accredited with PSETA and the partners are accredited assessors and moderators. We have been instrumental in developing the curriculum framework for finance management staff in the public sector under the CBMFM project spear headed by National Treasury. We also developed as part of the standard generating body unit standards for the Standard Chart of Accounts for National and Provincial Governments. We have significant experience in:

- Alignment of existing training material to relevant SAQA – registered unit standards

- Drawing up new unit standards

- Design of assessment instruments

- Development of learning material

We can offer the following learning programme

- Annual financial statement preparation for provincial and national departments

- Asset management

- The basics of budgeting

- Bid committees (Supply chain management)

- Finance for finance officials

- Finance for non finance officials

- Standard Chart of Accounts

TRAINING VENUE

Rates include:

- Venue hire

- Arrival tea and coffee

- Mid morning teas and coffees

- Mid afternoon teas and coffees

- Assorted sweets

- Secure parking

- Wireless connectivity

- Electronic screen

- Flip chart and pens

- Contact us for meal options

Contact us on 031 – 502 5617 or email : invictus@invictus.co.za